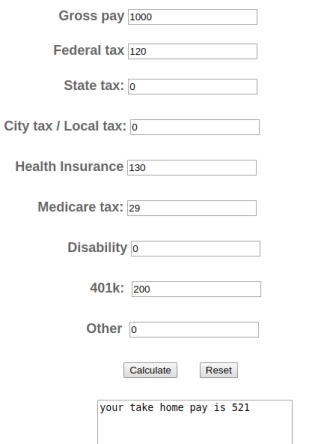

Paycheck calculator with insurance deductions

Use this calculator to help you determine the impact of changing your payroll deductions. Need help calculating paychecks.

The Measure Of A Plan

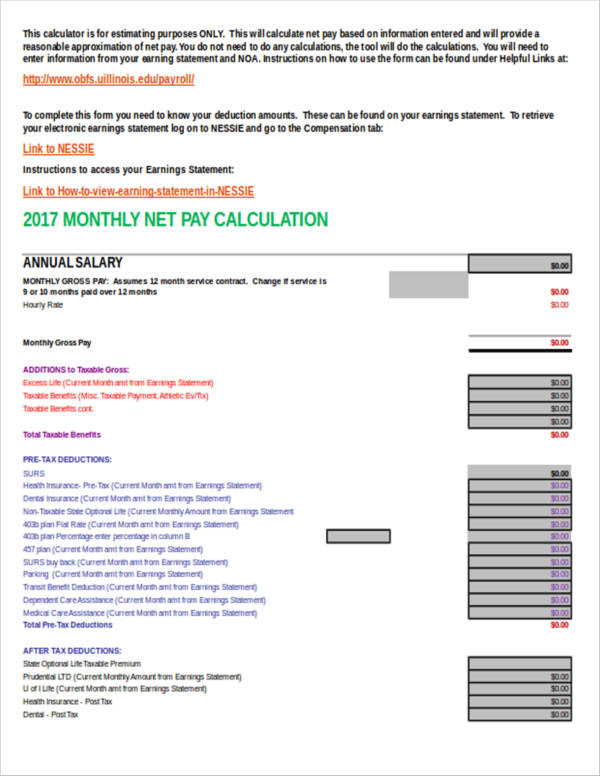

While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding.

. You can use the calculator to compare your salaries between 2017 and 2022. The impact on your paycheck might be less than you think. Dont want to calculate this by hand.

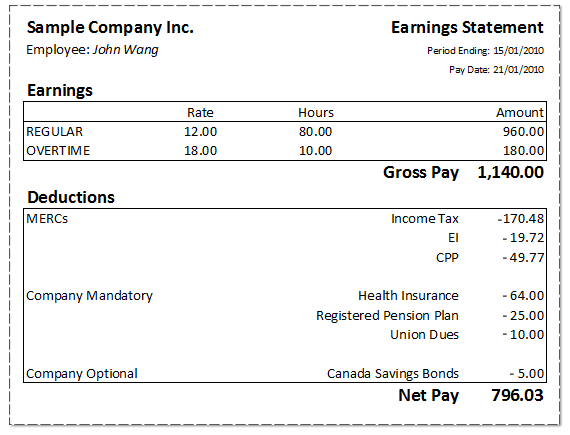

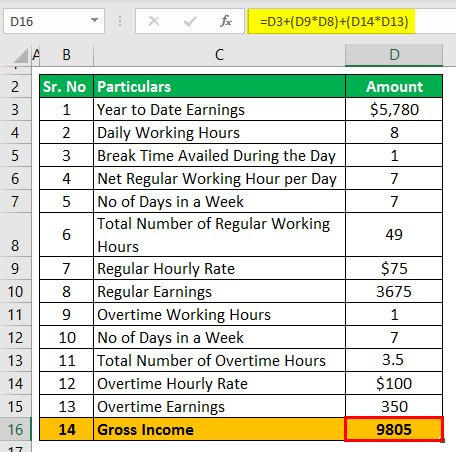

These deductions might include insurance premiums and HSA withholdings retirement and 401k withholdings and deductions for uniform fees or meals. Usage of the Payroll Calculator. An employees gross pay is the full amount an employer pays before deductions are taken out.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. This number is the gross pay per pay period.

Is employee subject to NY State Disability Insurance. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

You can enter your current payroll information and deductions and then compare them to your proposed deductions. Hourly Paycheck and Payroll Calculator. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Show More Inputs. The calculator is updated with the tax rates of all Canadian provinces and territories. While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes.

Show More Inputs. Enter your pay rate. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. 2022 W-4 Help for Sections 2 3 and 4. Free Federal and New York Paycheck Withholding Calculator.

This includes bonuses overtime pay and commissions which are part of. Before Tax Retirement Deductions. Check if you want Social Security.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Typically this is your gross earnings minus employer paid health insurance and any Flexible Spending Account FSA. These are the deductions to be withheld from the employees salary by their employer before the salary can be paid out including 401k the employees share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc.

The amount can be hourly daily weekly monthly or even annual earnings. The PaycheckCity salary calculator will do the calculating for you. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

NY Family Leave Insurance. Other gross pay contributors. Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Net Pay Step By Step Example

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Ready To Use Paycheck Calculator Excel Template Msofficegeek

1wxmydejhzto9m

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly Paycheck Calculator Step By Step With Examples

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Net Pay Calc Deals 50 Off Www Wtashows Com

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Take Home Salary Calculator Store 50 Off Www Wtashows Com

Take Home Pay Calculator Top Sellers 59 Off Www Wtashows Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Mathematics For Work And Everyday Life

Ready To Use Paycheck Calculator Excel Template Msofficegeek