Standard deduction federal income tax 2020

12 22000 to. This is an increase from the 6500 that was set in 2019.

Tax Rates Standard Deductions Heemer Klein Cpas

Understand The Major Changes.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

. IRS standard deduction Earned Income Tax Credit EIC. If taxable income is under 22000. The other six tax brackets set by the IRS are.

Ad 4 Ways Your Tax Filing Will Be Different Next Year. Ad Prevent Tax Liens From Being Imposed On You. Under United States tax law the standard deduction is a dollar amount that non-itemizers may subtract from their income before income tax but not other kinds of tax such as payroll tax is.

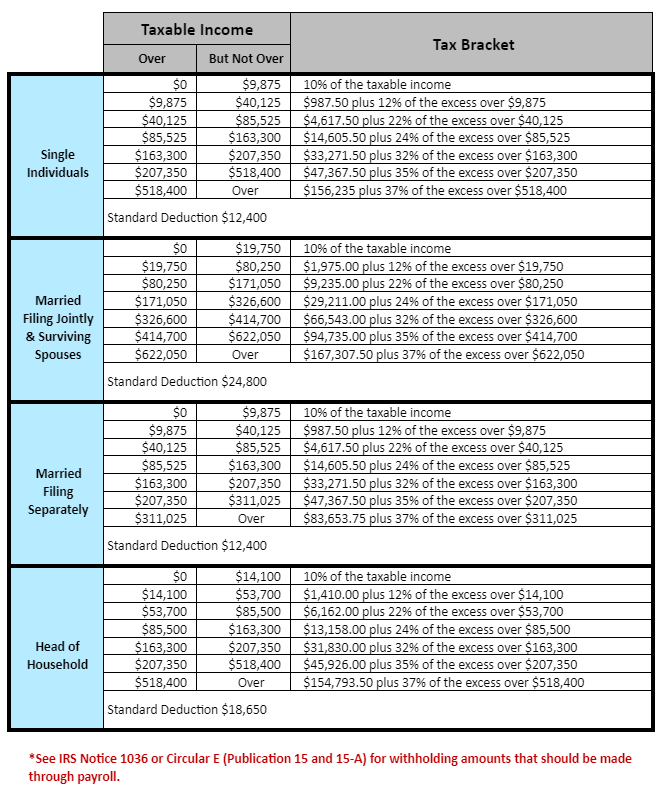

Individual Income Tax Rate Brackets Married Filing Jointly and Surviving Spouses Projected 2023 Tax Rate Bracket Income Ranges. Theres an additional standard deduction for people who turned 65 or older in 2020 or who are blind. There is an additional standard deduction of 1300 for taxpayers who are over age 65 or blind.

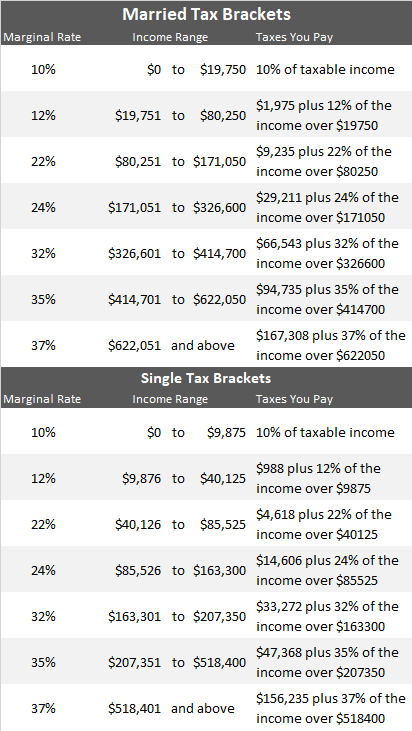

10 0 to 22000. Maximize Your Tax Refund. For married individuals filing joint returns and surviving spouses.

CPA Professional Review. If your income was 3200 you standard deduction would be. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by.

The standard deductions for individuals will be 12000 in 2020. The tax rate schedules for 2023 will be as follows. The stand- ard deduction for taxpayers who dont itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2020 than it was for 2019.

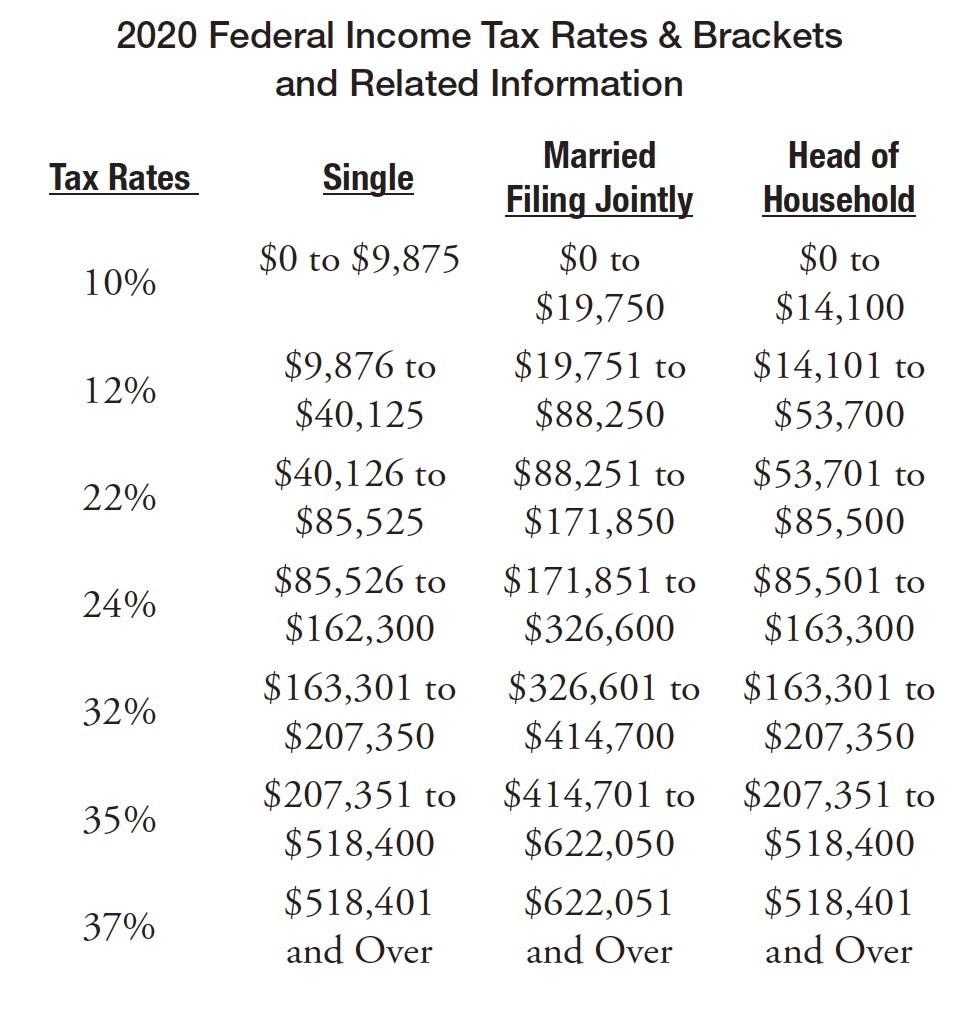

As noted above the top tax bracket remains at 37. Irs Standard Deduction 2020 Married Filing Jointly will sometimes glitch and take you a long time to try different solutions. The IRS has increased the 2022 tax brackets in order to adjust for inflation.

415 20 votes. Check For the Latest Updates and Resources Throughout The Tax Season. There are seven federal tax brackets for tax year 2022 the same as for 2021.

As a dependent if. Here are the 2020 standard deductions amounts for each filing status. Partner with Aprio to claim valuable RD tax credits with confidence.

Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age andor blindness. The PTE owners get either a state tax. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year.

3600 as the sum of 3200 plus 400 is 3400 thus greater than 1150. In general the standard. The tax is 10 of.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. The standard deduction for the year 2020 is 12000. The rates apply to taxable incomeadjusted gross income minus either the standard deduction or allowable itemized deductionsIncome up to.

Under this regime the PTE deducts the state income tax as a federal business deduction which is not subject to the 10000 SALT cap. LoginAsk is here to help you access Irs Standard Deduction 2020.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Inkwiry Federal Income Tax Brackets

Standard Deduction Definition Taxedu Tax Foundation

Tax Rates Standard Deductions Heemer Klein Cpas

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

2020 2021 Federal Income Tax Brackets A Side By Side Comparison Gone On Fire

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Your Guide To 2020 Federal Tax Brackets And Rates

2021 Tax Thresholds Hkp Seattle

2021 Tax Brackets Standard Deductions Dsj Cpa

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

2021 Tax Brackets Standard Deductions Dsj Cpa

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc